Are you tired of spending hours tangled in complicated spreadsheets and endless receipts? Imagine an accounting tool that understands you, listens to your questions in plain English, and handles the hard work for you.

That’s exactly what Adam, the AI-powered accounting platform, offers. With Adam by your side, managing your finances becomes simple and stress-free. Ready to take control of your bookkeeping without the usual hassle? Keep reading to discover how Adam can transform your financial management with ease.

Credit: www.truewind.ai

Introduction To Ai-powered Accounting Platforms

AI-powered accounting platforms are changing how businesses handle finances. These platforms use artificial intelligence to simplify bookkeeping and financial tasks. They reduce manual work and help users make smarter decisions faster.

One example is Adam, an AI assistant that manages your finances by understanding plain English commands. It takes the stress out of accounting and helps you stay on top of your money.

Understanding Ai In Modern Accounting

Artificial intelligence uses algorithms to analyze financial data quickly. It automates repetitive tasks like data entry, invoicing, and expense tracking.

AI systems learn from data patterns and improve over time. This reduces errors and speeds up accounting processes.

- Automates routine bookkeeping

- Detects anomalies and errors

- Generates financial reports instantly

- Understands natural language commands

How Ai Transforms Financial Management

AI tools provide real-time insights into cash flow and expenses. They help forecast future budgets based on past trends.

AI platforms enable faster decision-making by offering clear, data-driven advice.

| Traditional Accounting | AI-Powered Accounting |

|---|---|

| Manual data entry | Automated data processing |

| Slow report generation | Instant financial reports |

| High error risk | Accurate, error-reduced results |

| Limited forecasting | Advanced predictive analytics |

Why Businesses Need Ai-powered Accounting Now

Businesses face complex financial tasks and tight deadlines. AI-powered platforms cut time spent on accounting by up to 70%.

They provide clear views of finances, improving budgeting and compliance.

- Save time and reduce manual work

- Get accurate, up-to-date financial data

- Make better decisions with real-time insights

- Stay compliant with changing regulations

Tools like Adam make managing money simple. Just talk in plain English and let AI handle the rest.

Credit: www.hubifi.com

Key Features Of Ai-powered Accounting Platforms

AI-powered accounting platforms bring powerful tools to simplify financial tasks. They reduce manual work and improve accuracy. These platforms help businesses save time and make smarter decisions.

Automated Data Entry And Transaction Categorization

AI automatically captures financial data from receipts, invoices, and bank feeds. It sorts transactions into categories like expenses, income, and taxes. This reduces errors and frees up time for other tasks.

- Extracts data from multiple sources

- Sorts transactions by type and purpose

- Reduces manual entry and mistakes

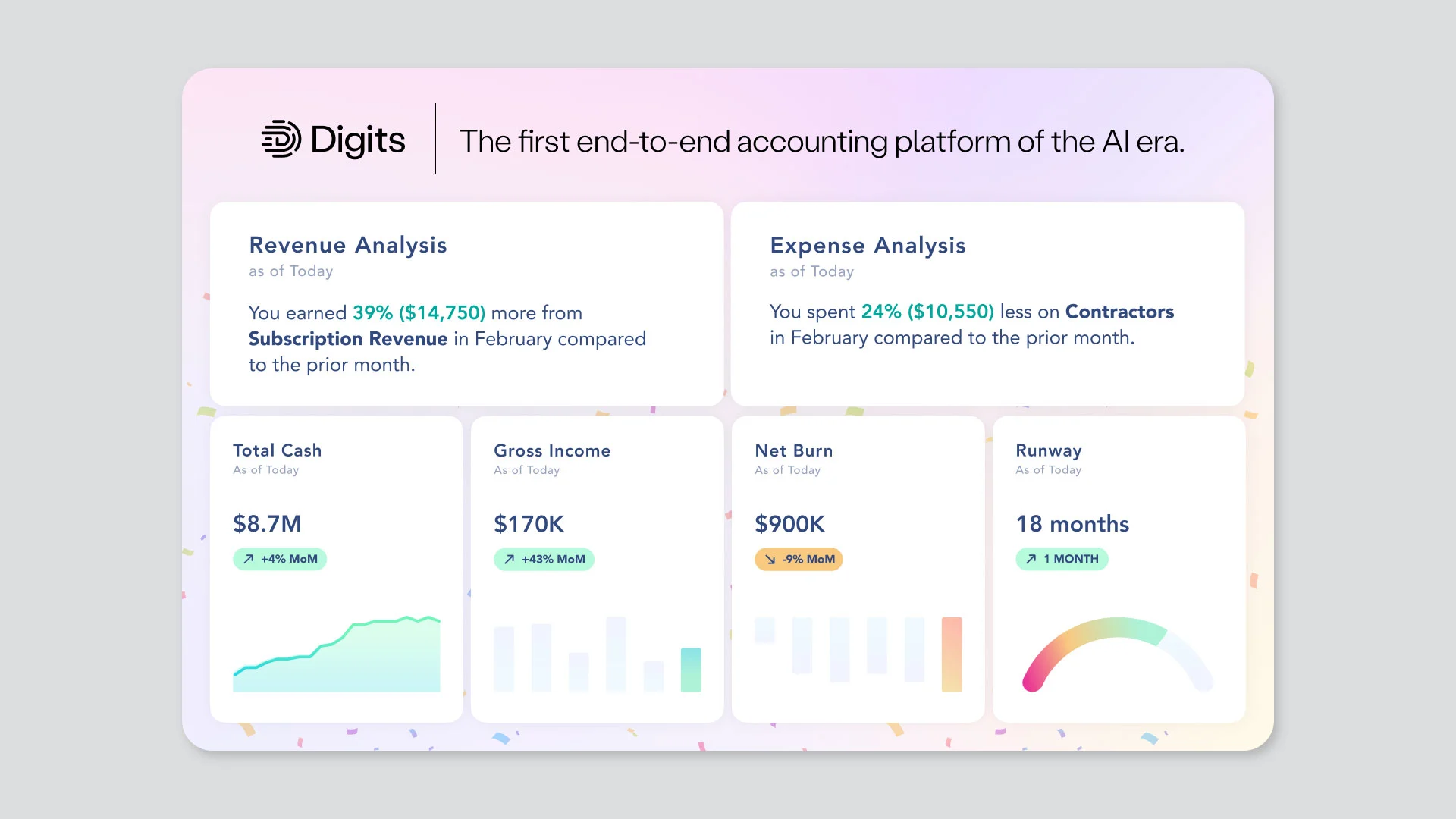

Real-time Financial Reporting And Analytics

Instant reports show current financial health. Dashboards display income, expenses, profits, and losses. Users get clear insights to track performance and spot issues fast.

- Customizable reports updated instantly

- Visual charts and graphs for easy understanding

- Helps monitor cash flow and profitability

Predictive Cash Flow And Budget Forecasting

AI predicts future cash flow based on past data and trends. It forecasts budgets to help plan spending and avoid shortages. This feature supports smarter financial planning.

- Analyzes historical transactions

- Forecasts income and expenses

- Alerts for potential cash shortfalls

Smart Invoice Processing And Payment Reminders

Invoices get created and sent automatically. AI tracks due dates and sends payment reminders to clients. This speeds up collections and improves cash flow.

- Generates invoices with minimal input

- Sends automatic payment reminders

- Reduces late payments and improves collections

Seamless Integration With Existing Financial Tools

AI platforms connect easily with popular accounting and banking software. Data flows smoothly between systems without manual export or import. This keeps workflows efficient and consistent.

| Integration Feature | Benefit |

|---|---|

| Connects to bank accounts | Automatic transaction syncing |

| Works with payroll systems | Streamlines employee payments |

| Compatible with tax software | Simplifies tax filing |

Pricing And Affordability Breakdown

The pricing of an AI-powered accounting platform like Adam plays a crucial role in its appeal. Understanding the costs helps small businesses and freelancers decide if the investment fits their budget. This section breaks down subscription models, evaluates cost versus value, and compares Adam’s pricing with traditional accounting software.

Overview Of Subscription Models And Plans

Adam offers flexible subscription plans designed for different user needs. The pricing is straightforward, with options to suit freelancers, small businesses, and larger teams.

- Monthly Plan: Pay month-to-month with no long-term commitment.

- Annual Plan: A discounted rate compared to monthly billing, ideal for regular users.

- Enterprise Plan: Custom pricing for larger businesses needing advanced features and support.

Each plan includes access to the AI assistant, automated bookkeeping, expense tracking, and real-time financial insights.

Cost Vs. Value: What You Get For Your Investment

The cost of Adam reflects the value it provides through automation and ease of use. The AI assistant reduces time spent on manual entry and errors.

Key benefits include:

- Simple plain-English interaction for ease of use

- Automated transaction categorization

- Instant financial summaries and reports

- Reduced need for expensive accounting services

The time saved and accuracy gained often outweigh the subscription cost. Users get a reliable tool that streamlines complex accounting tasks.

Comparison With Traditional Accounting Software Costs

| Feature | Adam (AI-Powered) | Traditional Software |

|---|---|---|

| Starting Price | $15/month (approx.) | $30-$50/month |

| Setup and Training | Minimal, AI guides user | Often requires manual setup and learning |

| Automation Level | High, AI handles bookkeeping | Medium, mostly manual input |

| Support | AI assistance + customer support | Customer support only |

| Additional Costs | Few, mostly included | Possible add-ons and upgrades |

The lower cost and high automation of Adam make it affordable for small teams. Traditional software often requires more time and money.

Pros And Cons Based On Real-world Usage

Using an AI-powered accounting platform like Adam offers clear benefits and some challenges. Real users highlight how this technology changes daily financial tasks. Below, the main advantages and potential drawbacks appear in detail. User feedback provides valuable insights into performance and usability.

Advantages: Efficiency, Accuracy, And Time Savings

- Efficiency: Adam automates repetitive tasks, reducing manual work significantly.

- Accuracy: AI minimizes human errors in data entry and calculations.

- Time Savings: Users complete bookkeeping faster by simply speaking in plain English.

Adam’s ability to understand natural language means less training is required for basic accounting queries. This results in quicker responses and smoother workflows.

Potential Challenges: Learning Curve And Data Security

- Learning Curve: Some users need time to adapt to AI commands and features.

- Data Security: Handling sensitive financial data demands strong protection measures.

Trust in AI platforms depends on the robustness of their security protocols. Users expect encryption and strict privacy standards to keep their information safe.

User Feedback And Performance Insights

| Aspect | User Experience | Performance Notes |

|---|---|---|

| Usability | Simple interface with plain English input praised | Some features need clearer guidance for beginners |

| Accuracy | Reports and calculations mostly error-free | Rare glitches reported during data import |

| Speed | Tasks completed faster than manual methods | Occasional delays during high server load |

Overall, users appreciate how Adam reduces their accounting workload. Minor issues do not overshadow the platform’s core benefits.

Ideal Users And Use Cases For Ai-powered Accounting

AI-powered accounting platforms like Adam simplify financial management for various users. They automate tasks, reduce errors, and save time. These platforms suit different business sizes and professionals who want easy, accurate bookkeeping.

Small And Medium-sized Businesses Looking To Scale

Small and medium businesses gain efficiency by automating routine accounting tasks. Adam helps by:

- Tracking expenses and income automatically

- Generating financial reports quickly

- Providing real-time insights for better decisions

As these businesses grow, Adam scales with them, handling increasing financial complexity without extra effort.

Freelancers And Entrepreneurs Managing Finances Solo

Freelancers and solo entrepreneurs juggle many roles, including finance. Adam simplifies this by:

- Allowing plain English commands to manage accounts

- Reducing time spent on bookkeeping

- Organizing invoices and payments automatically

This helps individuals focus on work instead of financial details.

Accounting Professionals Seeking Automation Tools

Accountants benefit from AI tools like Adam to:

- Automate repetitive tasks such as data entry

- Increase accuracy by minimizing human errors

- Speed up report generation and analysis

These features let professionals serve more clients efficiently.

Industries That Benefit The Most From Ai Integration

| Industry | Benefits of AI-Powered Accounting |

|---|---|

| Retail | Real-time sales tracking and inventory management |

| Consulting | Automated billing and expense tracking |

| Healthcare | Accurate patient billing and compliance reporting |

| Technology | Financial forecasting and project cost tracking |

Conclusion: Revolutionizing Your Finance With Ai

AI-powered accounting platforms like Adam simplify financial management. They reduce manual work and errors. These tools help you focus on important decisions.

By using AI, managing your books becomes faster and clearer. You just talk to Adam in plain English. It handles bookkeeping and financial tasks smoothly.

Summary Of Benefits And Key Takeaways

- Time-saving: Automates routine accounting tasks.

- Accuracy: Minimizes errors in financial data.

- Ease of use: Simple, conversational interface.

- Insightful reports: Clear financial summaries and insights.

- Accessibility: Manage finances anytime, anywhere.

Adam brings all these benefits together. It makes bookkeeping less stressful and more efficient.

Future Trends In Ai Accounting Technology

- Advanced automation: More tasks handled without human input.

- Real-time analytics: Instant financial insights and alerts.

- Voice interaction: Improved natural language understanding.

- Integration: Seamless connection with other business tools.

- Security: Enhanced data protection and privacy measures.

These trends will make AI accounting platforms smarter and safer. Businesses will gain faster, clearer financial control.

How To Get Started With An Ai-powered Accounting Platform

- Choose the right tool: Select a platform like Adam that fits your needs.

- Create an account: Sign up and link your financial data securely.

- Explore features: Use the conversational interface to manage tasks.

- Set up reports: Customize financial summaries for your business.

- Review regularly: Check insights and adjust your financial plans.

Starting is simple. Adam’s user-friendly design helps anyone manage finances easily.

Credit: www.fastcompany.com

Frequently Asked Questions

What Is An Ai-powered Accounting Platform?

An AI-powered accounting platform uses artificial intelligence to automate financial tasks. It improves accuracy and saves time by handling data entry, invoicing, and report generation efficiently.

How Does Ai Improve Accounting Accuracy?

AI reduces human errors by automating calculations and data processing. It detects anomalies and inconsistencies quickly, ensuring financial records are reliable and precise.

Can Ai Accounting Platforms Integrate With Existing Software?

Yes, most AI accounting platforms support integration with popular ERP and CRM systems. This allows seamless data flow and enhances overall business efficiency.

Are Ai Accounting Platforms Secure For Sensitive Data?

AI platforms use advanced encryption and security protocols. They protect sensitive financial information from unauthorized access and cyber threats effectively.

Conclusion

Managing finances can feel tough and time-consuming. Adam, an AI-powered accounting platform, simplifies this task. It understands plain English and handles bookkeeping for you. This tool saves time and reduces errors in your accounts. Using Adam makes financial management clear and easy. Explore how Adam can help you stay organized and stress-free. Find out more about Adam’s features and benefits here: Adam.